5 Easy Facts About Offshore Banking Explained

Table of Contents4 Simple Techniques For Offshore BankingAn Unbiased View of Offshore BankingThings about Offshore BankingSome Of Offshore BankingNot known Details About Offshore Banking

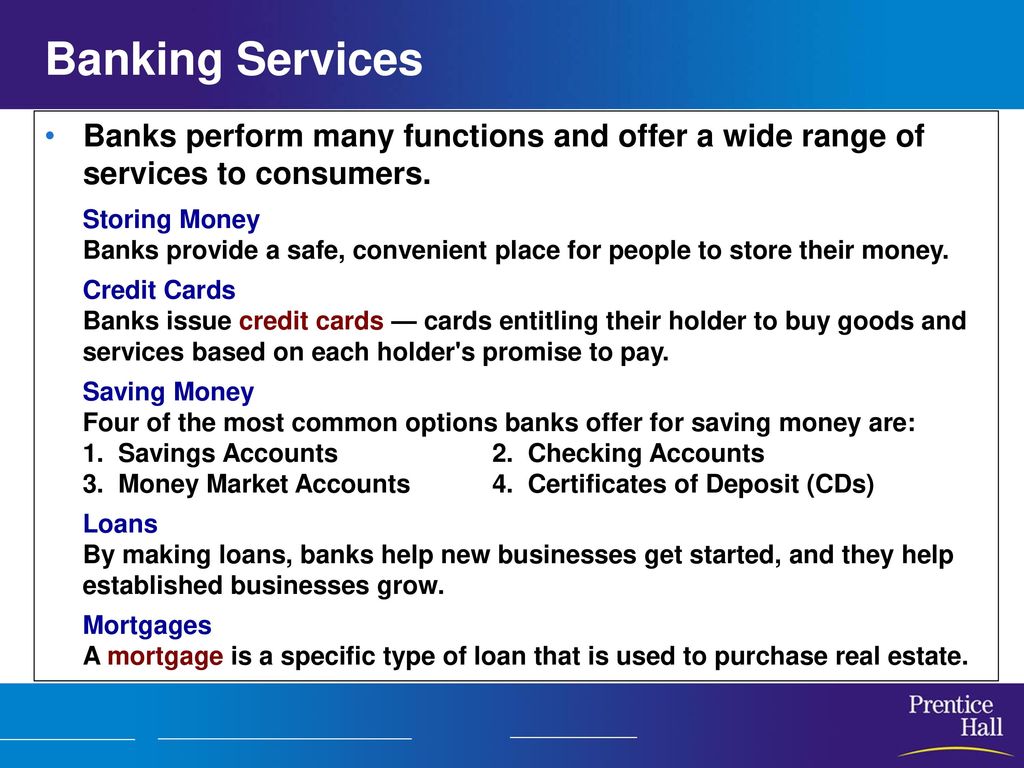

Some typical types of fundings that financial institutions give include: If your existing financial organization doesn't provide the solutions stated over, you might not be getting the very best financial service feasible. Initially Bank, we are devoted to helping our customers obtain one of the most out of their money. That is why we use various sorts of banking solutions to satisfy a range of requirements.

Pay expenses, rent out or top up, purchase transport tickets and also even more in 24,000 UK areas

That's because there are lots of kinds of banks and also monetary institutions. By recognizing the different types of banks as well as their features, you'll have a much better sense of why they're important and how they play a duty in the economic climate.

6 Simple Techniques For Offshore Banking

In regards to banks, the central bank is the executive. Main banks manage the cash supply in a single country or a collection of nations. They manage commercial banks, established rate of interest and also manage the flow of currency. Reserve banks likewise carry out a federal government's monetary policy goals, whether that involves combating deflation or keeping prices from fluctuating.

Retail banks can be conventional, brick-and-mortar brands that clients can access in-person, online or via their mobile phones. Others only make their tools and accounts readily available online or through mobile apps. There are some types of commercial financial institutions that help everyday customers, business financial institutions tend to concentrate on sustaining organizations.

The darkness banking system contains financial teams that aren't bound by the very same rigorous guidelines as well as guidelines that other banks have to follow. A lot like the typical regulated financial institutions, darkness financial institutions manage credit scores and different kinds of properties. But they obtain their funding by borrowing it, connecting with financiers or making their very own funds rather than using money issued by the reserve bank.

Cooperatives can be either retail banks or industrial banks. What differentiates them from other entities in the economic system is the reality that they're generally neighborhood or community-based associations whose participants aid establish how the service is operated. They're run democratically and also they use loans and checking accounts, to name a few points.

Some Known Incorrect Statements About Offshore Banking

Like financial institutions, debt unions provide loans, provide financial savings and inspecting accounts as well as satisfy various other monetary needs for customers and also services. The difference is that banks are for-profit business while credit unions are not - offshore banking.

Members benefited from the S&L's services and also earned more interest from their cost savings than they might at business banks (offshore banking). Not all banks offer the same function.

In time, they have been widely utilized by both advanced get managers and also by those with even more straightforward demands. visite site Sight/notice accounts as well as taken care of and floating price down payments Fixed-term deposits, likewise denominated in a basket of money such as the SDR Versatile amounts and maturations An attractive investment widely utilized by book managers searching for extra yield as well as outstanding credit rating top quality.

This paper presents a technique that banks can make use of to help "unbanked" householdsthose that do not have accounts at down payment institutionsto join the mainstream monetary system. The main objective of the approach is to assist these houses develop financial savings and also enhance their credit-risk accounts in order to lower their cost of payment services, get rid of a common resource of individual anxiety, and also gain accessibility to lower-cost sources of credit report.

The Main Principles Of Offshore Banking

Second, it will offer them a collection of solutions far better developed to meet their requirements. Third, it is better structured to assist the unbanked become typical bank consumers. 4th, it is also most likely to be a lot more profitable for financial institutions, making them much more ready to execute it. Numerous studies have taken a look at the socioeconomic qualities of the approximately 10 discover this million houses that do not have savings account.

They have no immediate requirement for credit or do not locate that their unbanked status excludes them from the credit report that they do require. Repayment services are additionally not troublesome for a variety of factors.

Most banks in city locations will not cash incomes for individuals that do not have an account at the bank or who do not have an account with adequate funds in the account to cover the check. It can be fairly costly for a person living from income to income to open up a bank account, even one with a reduced minimum-balance requirement.

Each jumped check can cost the account owner $40 or more because both the check-writer's financial institution and the seller who accepted the check website link commonly impose penalty costs. It is additionally costly as well as bothersome for bank clients without examining accounts to make long-distance settlements. Nearly all financial institutions charge a minimum of $1 for cash orders, as well as numerous cost as high as $3.

Excitement About Offshore Banking

As kept in mind in the introduction, this paper argues that the most effective and also inexpensive means to bring the unbanked into the banking system need to entail five measures. Below is an explanation of each of those measures and their rationales. The primary step in the recommended approach contacts getting involved banks to open specialized branches that provide the full variety of commercial check-cashing solutions as well as conventional customer banking solutions.